Dan and Sammy Harkham

Cinefamily’s “Sole Member” (and his understudy)

L to R: Hadrian Belove, Dan Harkham, Sammy Harkham (Source: Getty Images)

The name most associated with Cinefamily in the public imagination is Hadrian Belove, but Belove was technically the hired help. Even longtime Cinefamily fans may not know that brothers Dan and Sammy Harkham had effective control over Cinefamily operations, finances, and governance; this fact was not widely advertised. Key information to put the puzzle together is dispersed across a range of legal documents. Some versions of those documents improperly omitted a critical disclosure about the role of the Harkhams in Cinefamily.

Press accounts commonly refer to Dan and Sammy Harkham as the owners of the Silent Movie Theater, and Cinefamily’s landlord. Technically, even this is not true: the property is owned by Harkham Family Enterprises, which is controlled by Dan and Sammy’s father, Uri Harkham. (In a 2017 press account, Uri indicated Dan and Sammy were in control. We will therefore follow the convention of referring to Dan and Sammy Harkham as building owners.) Cinefamily paid the Harkhams $114,000 in rent in 2014, according to tax filings.

Press accounts describe the Harkhams as founders of Cinefamily in addition to landlords. This is true, but incomplete. Legal documents show their role to be still more significant—and ongoing.

At most nonprofits, just like at most for-profits, the buck stops with the board of directors. We find the list of board members in Cinefamily’s 2014 Form 990, along with a summary.

18 board members are listed. 16 of them are considered “independent.” (Belove was a compensated executive and Dan Harkham owns the building.)

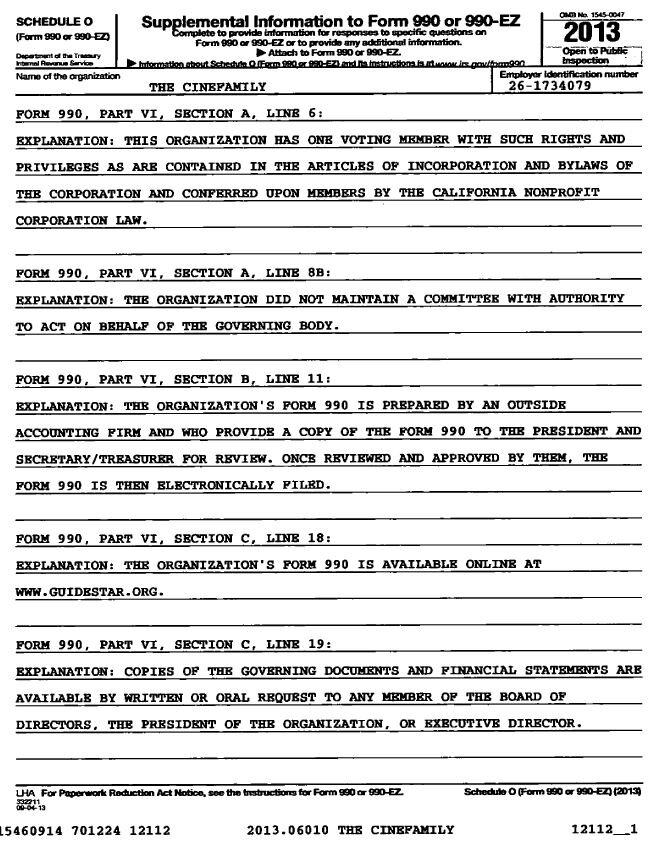

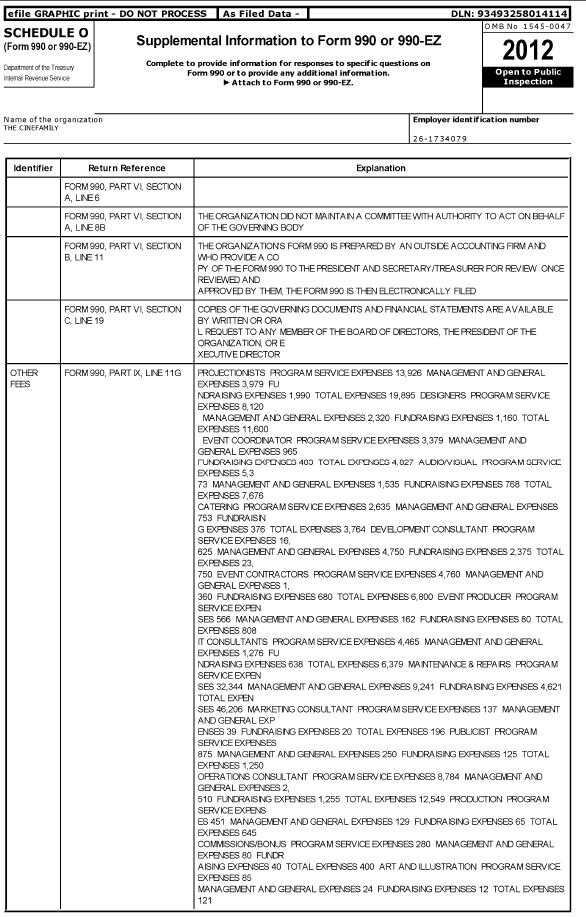

(Note: Highlighting added. 2014 filings are marked “2013” and 2013 filings are marked “2012.”)

Normally, the investigation would end here (or, rather, with the list of the 18 named directors on the following page). Note, however, question six: “Did the organization have members or stockholders?” This “yes” is unusual. It requires an additional disclosure in the document’s Schedule O.

So there’s both 18 directors, and also “one voting member with such rights and privileges” as are described elsewhere. (We’ll get to those rights and privileges in a moment.) Legalzoom explains that “most nonprofits (especially smaller ones) do not have members, due to the additional paperwork and required formalities.” In other words, most nonprofits leave decision-making to directors. Cinefamily is not most nonprofits.

(Note that “member” in this sense is akin to corporate “shareholder” or “owner.” Do not confuse this sense of “member” with the common parlance in which, e.g., Cinefamily patrons were “black card members.” Being a Cinefamily member in the common parlance grants no noteworthy legal rights in this context.)

According to 501c3 Law Blog.com, when libertarian think tank Cato Institute established itself as a nonprofit with a member, it had “people across the country scratching their heads.” At Cato it was not about financial enrichment: “the structure is just a means by which to control the organization” (emphasis added).

In November 2017, CinefamilyAccountability asked a lawyer with expertise in nonprofit board governance to review Cinefamily's legal filings. She called this sort of structure “sketchy.”

So who is this one voting member, and what are these rights and privileges? The Amended and Restated Articles of Incorporation give a partial answer:

The Amended and Restated Bylaws are a bit more clear:

This filing with the California Franchise Tax Board seems to state it most succinctly:

It is not clear to this website, however, how Dan Harkham’s control over Cinefamily’s decision-making was exercised. If control was indirect, board members would presumably have made decisions knowing they were ultimately accountable to one person—Dan Harkham. If control was direct, Harkham presumably would have simply made all decisions, with any board actions merely for show. Board members may or may not have understood this dynamic.

So what of Sammy, other than standing ready to serve “following the death or inability” of his younger brother? We’re not sure. He was an on-and-off Cinefamily director over the years. In early 2017, he told The Comics Journal “Since the [2016] election, I am trying to focus my attention on the local, the community around me.” In 2018 Sammy told CinefamilyAccountability he is spearheading Fairfax Cinema. A person once close with Sammy Harkham—the person was able to describe the short film Sammy directed—expressed concern. On seeing the abstract neon lighting installed at the Silent Movie Theater in September 2019, the person wondered aloud if this was “Sammy Harkham’s midlife crisis.”

There is one final wrinkle related to Dan Harkham's special status. Checking that "member or shareholder" box on the annual tax form required an additional disclosure on Schedule O, but most people interested in Cinefamily's governance likely never saw any disclosure.

Guidestar is "the world's largest source of information on nonprofit organizations," and is typically the first stop for most people seeking a nonprofit's 990s. Guidestar explains they get 990s from the IRS but that "Any organization in the database can also post PDF files of its 990s;" Guidestar provides no additional details on oversight or quality control covering voluntary uploads from individual nonprofits.

I accessed the same filing through Guidestar (seen on the left) as through the California Attorney General's office (seen on the right). One would expect the documents to be identical, but one key disclosure appears to have been redacted from the Guidestar version in 2014:

2014 990 Schedule O (Source: Guidestar)

2014 990 Schedule O (Source: California Attorney General)

And for 2013:

2013 990 Schedule O (Source: Guidestar)

2013 990 Schedule O (Source: California Attorney General)

I have asked Guidestar for clarification and will update if I hear back. There is no reason to assume this discrepancy was improper, deliberate, or any attempt to obfuscate. Regardless of intent, crucial governance information was unavailable to Cinefamily stakeholders.

UPDATE 1/11/18: The good folks at Guidestar were gracious enough to make some time to talk with me about this. According to Guidestar's Director of Data Operations Holly Ivel, the 990 accessed through Guidestar was directly submitted to the IRS electronically, while the version accessed through the AG's office was submitted directly to the AG. Ms. Ivel believes the missing information in the Schedule O accessed via Guidestar is the result of an accidental bug in the IRS's data-population system, and (while perhaps unfortunate) is not in any way improper.

Ms. Ivel also notes that the deadline to file the annual 990 is 5 months and 15 days after the end of the fiscal year—which for Cinefamily is October 31—but that organizations may request up to six months of extensions. Even assuming the full allowable extensions, Ms. Ivel believes the IRS would have processed and released the 2015 990 in around December 2016 or January 2017. She said there is likely no way to know now if Cinefamily filed late or if they have still not filed.